Shelter your home, auto, savings, and everything else you own from creditors!

Divorce-proof your assets!

Block the IRS from levying your wages or seizing your property!

Gain total financial privacy!

Open a bank or brokerage account without providing your Social Security number!

The litigation explosion, Why you should have a corporation - even if you don't own a business!

Sounds great, right? Google "bullet proof asset protection" (in quotes) and almost 14 thousand websites show up.

Here's the problem: bullet proof asset protection is a lie. Oh, and that "ad" above? It's from Bill Reed, and according to Webwire, "A federal judge in St. Louis has permanently barred William S.Reed, the founder of a so-called “asset protection” business, from preparing fraudulent liens for customers and helping customers conceal their funds by having shell corporations own their bank accounts, the Justice Department announced today."

Certainly, there are legitimate things one can do to better protect assets. However, 1) nothing is 100% effective, 2) nothing will allow you to completely avoid your tax obligations, 3) nothing will allow you to commit fraud and crime unimpeded.

I am writing this article because from time to time I see high-pressure "planners" pitch expensive "trusts" to unsuspecting people here in Cobb County, Georgia. They claim that the trusts will avoid creditors, taxes, and medicaid recovery. Typically, these are just revocable trusts. Since they are revocable, they don't protect against anything and are really just for avoiding the probate process. In Georgia, revocable trusts are subject to the creditors of one's estate at death if there are insufficient assets in the probate estate. As such, they are NOT asset protection tools. Moreover, these trusts tend to be written by attorneys in other states. What a terrible situation to have to deal with: a trust or a Will that has a different state's law apply for no legitimate reason. Remember: attorneys make a lot more money from bad Wills and trusts going to court then they do from planning. Probate litigation can easily cost tens of thousands of dollars. It is important therefore to make sure that the attorney you hire is very experienced, even if you have a small estate. The process here in Georgia to probate is generally the same regardless of the size of the estate, and I have seen plenty of $20,000 estates end up having $20,000 of attorneys fees due to poorly drafted documents. I have pretty much never seen a non-attorney completely and properly draft their own Will (but again just going to some random attorney won't fix the problem....attorneys need to be licensed in your state and experienced at drafting Wills. Even better if they have probate court experience defending their documents).

Now, back to the problems with "bullet proof asset protection".

Problem #1: Judges: Judges dislike defendants telling them they can't do something. Many of the asset protection planners have no courtroom experience. A judge isn't going to listen to the idea that a defendant cannot bring back assets that they embezzled because of some fancy Cook Island trust. As has been shown in some famous cases, such as the Lawrence case, the judge will simply incarcerate the defendant standing right in front of them for contempt, until such time as the assets are repatriated. The worst part about this is that this defendant may very well be unable to bring the assets back, yet the judge won't care. Why? Because the defendant is responsible for the problem, as the defendant put the assets in the trust.

I had a law professor once tell me, "If you cannot explain something to a judge on a 4th grade level, then you are going to lose." Although this may be a bit of an exaggeration, it is not much of one. Judges like short and simple explanations (and explanations that respect the judges power). Therefore, weaving a complex web of corporations, trusts, secret bank accounts, etc. will simply look like deception to a judge.

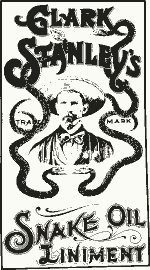

Silly arguments don't go over too well. Several years ago snake oil salesmen pitched Nevada corporations as "bullet proof asset protection" due to this made up idea of "bearer shares". The idea was that you set up a Nevada corporation, and had shares which state that whoever holds the shares owns the corporation. You then give the shares away to a person, who gives them away to another person. Then, if called into court, you could "truthfully" state that you do not know who actually owns the corporation. The problem with this? Each transfer of the corporation would be a taxable event, and would be reportable on tax returns. Failure to so report could mean either 1) this whole bearer share thing is a sham that should be ignored by the court, or 2) that the parties are committing tax fraud. If tax returns are filed, then they can easily be obtained by a Plaintiff. Nevada has since amended their laws to specifically disallow bearer shares, since this scam was giving Nevada a bad reputation.

Problem #2: Divorce, particularly with minor children: Judges have taken a dim view of the use of asset protection trusts to avoid child support obligations, and have not hesitated to incarcerate those who defy repatriation orders (even when it truly has been impossible to bring back assets).

Problem #3: Fraudulent transfers: Court can look back several years and undo transfers of assets that were for less than full value.

Problem #4: Bankruptcy: Bankruptcy judges have a great deal of power to bring assets back into the bankruptcy estate. Moreover, failure to list assets can be a reason to deny a discharge and dismiss a bankruptcy (which would make a debtor continue to be liable to creditors). Don't forget, these bankruptcy courts can use the same fraudulent laws to undo transfers for less than value. I saw this happen to investors who bought distressed real estate a few years ago from desperate people who then declared bankruptcy. The bankruptcy trustees argued that the real estate was bought for less than reasonably equivalent value and that therefore the sales of the property should be undone (and notice that there does not actually have to be any bad intent, just that it was for less than reasonably equivalent value).

Problem #5: The very determined creditor: Many of the asset protection plans are more like deterrents to litigation than they are "bullet proof". A determined creditor could sue anywhere, and could even utilize tools such as involuntary bankruptcies (which may expand the types of assets that could be available to creditors, in addition to being able to utilize the powers of the bankruptcy trustee). Contrary to much of what is written on the internet, it is often much cheaper to initiate litigation than it is to conduct extensive background checks, and then to develop what assets and entities there are through the discovery process.

Problem #6: The IRS: Don't cheat them. Bad idea. There is extensive reporting now for US citizens and tax residents (see some of my other blog posts). The consequences for failure to file can be dire, including criminal penalties. A department at the Treasury Department that looks into failure to file foreign bank account reports is titled "Global Financial Crimes".

Problem #7: Scams: I had clients be pitched by Stanford Group before Stanford Group was seized by the government (the clients fortunately did not invest with them). Part of their pitch was that by holding your money offshore it was asset protected. The problem? The government claims the entire operation was a Ponzi scheme. Don't forget, you can get judgments against wrongdoers, but that doesn't bring the money back if it has already been spent, and the con artist is insolvent.

Problem #8: Loss of control over assets: This problem exists even in legitimate plans. If you have complete control over an asset so can your creditors generally. Most of the assets protection structures will have at least some restrictions over your control of an asset, which may be unattractive.

Problem #9: Medicaid Recovery: Like fraudulent transfers, medicaid has a lookback period for transfer that are for less than equivilent value. Also, if you continue to use an asset, such as a house, it may not be considered transferred.

The solution?: Make sure that you do your planning before there are any lawsuits and while you are solvent. Be especially careful if you are thinking you will need nursing home medicaid in the next few years (and use a good elder care planner). Obviously, don't commit fraud and crimes. Have legitimate non-asset protection reasons for whatever structure you set up. Don't try to just hide assets as you could be forced to answer discovery questions anyway, and committing perjury is not a wise asset protection plan. Use counsel that is experienced in asset protection and is familiar with the court process, possible IRS challenges, etc. There aren't too many solutions to the loss of control problem mentioned above, and there will simply have to be cost/benefit/risk analysis done of any proposed structure.